Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first module of each course. Start Free

A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. The subscription agreement contains all the required details. It is used to keep track of outstanding shares and share ownership (who owns what and how much) and mitigate any potential legal disputes in the future regarding share payout.

Subscription agreements are important to understand when analyzing business partnerships and being an early owner, employee, or investor in a start-up.

Subscription agreements vary depending on the company they pertain to and the reason they are offered. Often, they will contain the details on a predetermined rate of return on the initial investment by a new investor into a company. It could be a percentage of corporate profits after the company passes certain agreed-upon financial milestones.

Subscription agreements generally are offered at earlier stages with start-up companies before they are able to access venture capital or are able to go public. A well organized and well-structured subscription agreement will include the details about the transaction, the number of shares being sold and the price per share, and any legally binding confidentiality agreements and clauses.

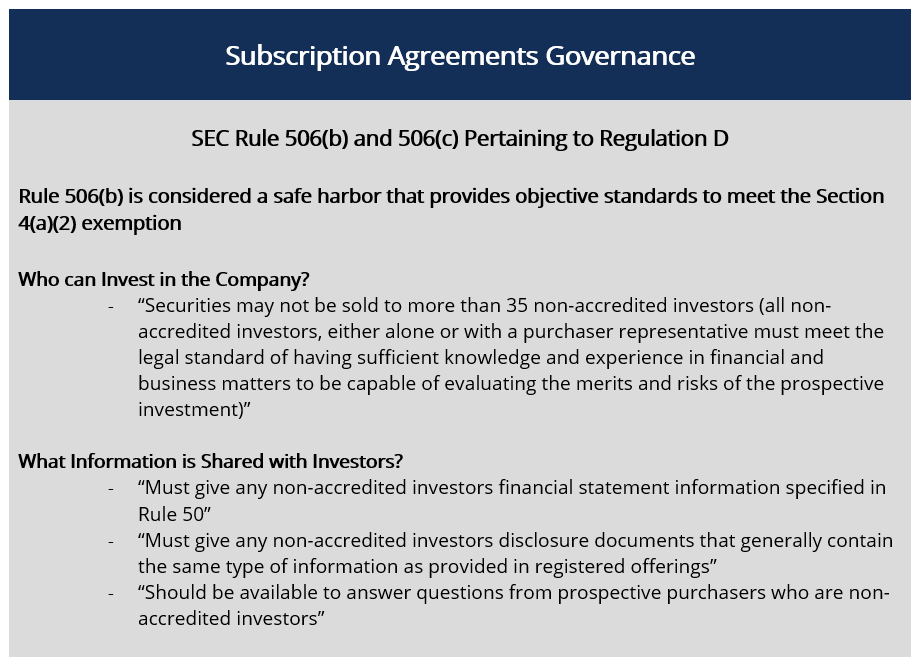

The graphic below shows the legal methods governing subscription agreements in the United States:

Subscription agreements are chosen for a few different reasons. They are primarily done because the company is not yet at a point where they can attract venture capital or investment banks to invest in their organization. The agreements are also done to raise money from private investors without registering with the Securities and Exchange Commission (SEC).

Thank you for reading CFI’s guide on Subscription Agreement. To keep learning and developing your knowledge of financial analysis, we highly recommend the additional resources below:

From equities, fixed income to derivatives, the CMSA certification bridges the gap from where you are now to where you want to be — a world-class capital markets analyst.